Over the last month in April, global supply chain is going through a huge disruption as United States had announced its reciprocal tariffs and postpone to give time to negotiate for a more favourable trade terms with its trading partners. In the meantime, building material and flooring industry are already significantly influence as shipment volume decreased and cost of importing at high uncertainties. Furthermore with crack downs on transshipment, with the intention to change finished good country-of-origin, China made goods are at distinctive disadvantage as it is imported into United States market.

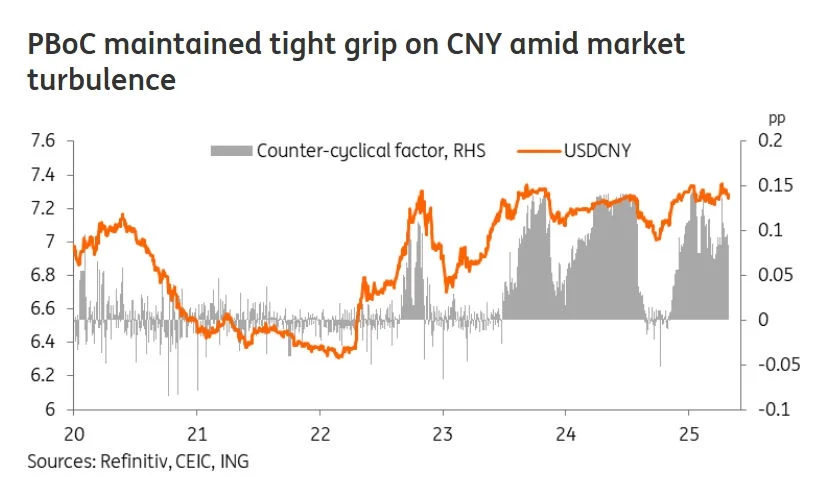

According to our industry insights and forwarders’ comment, US-bound shipments has decreased by 50% compare to previous month. There is also situation where the loaded goods are piled up at custom port which caused major liability issues for warehousing costs. This has resulted the Yuan to depreciate to a new peak, USD/CNY eclipsing upto 7.35 and back to around 7.26, according to ING Global Markets Research.

Will Chinese Yuan Continue to Depreciate?

According to ING analysis, it is still not clear whether Yuan will depreciate significantly just as it previous did from 2018, when first trade war took place. The reason for this uncertainty are due to different positioning of US currency, as well as facing different level of tariff and investment outflow pressures. So while the Yuan has stayed relatively steady against the Dollar, it has taken a hit against other currencies amid the broader dollar weakening trend.

Outlook remains highly uncertain given rapid change in tariff situations. There is still possibility that the Trump administration would further non-trade escalations. Therefore it is currently predicted that USD/CNY fluctuation band will range between 7.00-7.40 with year-end forecast of 7.30.