The main purpose of this Domotex observation report is to provide a better overview of the market dynamics and trends that is associated with decorative hard surface flooring industry. Through major international trade fairs and expos, we are hoping that our observations and some of the suggestions or ideas can help our clients, viewers or relevant professionals (who are interested in the hard surface flooring fields) to have a better understanding of new trends, innovations and shifts that is currently happening across different geographics.

Our Domotex observation report are carried out from participation of Domotex China 2023, Domotex Hanover 2024, from which some of the contexts are ongoing updates. We hope this little presentation are enjoyable for your read.

Summary Outtake from Previous 2023 Domotex China Observation Report

Mega Trend for Vinyl-Free Flooring Development

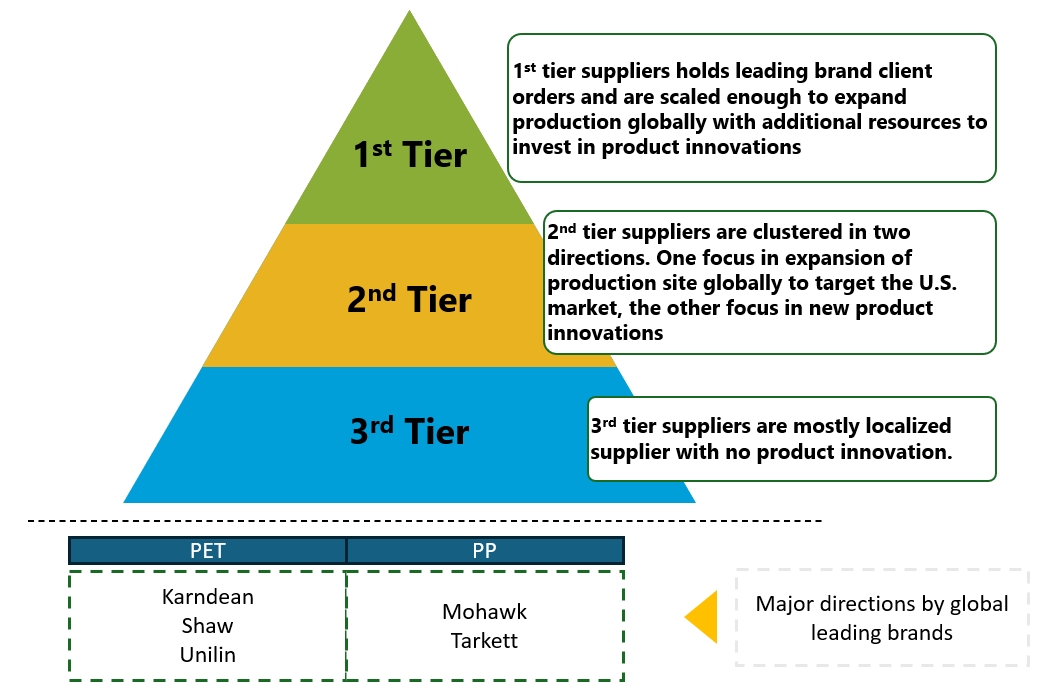

Viny-Free Floorings continue to be one of the most important product development trend in the industry. Not only we see first tier suppliers rolling out their vinyl free LVT and vinyl free SPC, we also were informed exclusive sales rights were demanded from leading flooring brand. This is an indication that it is in brands’ interest to eventually phase out PVC-based floorings, and they are strategically capturing exclusive suppliers in this line.

Vinyl-Free Floorings are currently being developed in two directions, one is PET polymer based, and the other Polypropylene (PP) based. There is no certainty which one will lead as we have observed different major brands has chosen different material (as well as relevant suppliers / developers as they are closely associated).

Vinyl Free LVT/SPC will be the mega trend, according to our experts. “More than half of the flooring brands that participated the Cologne Expo in Germany has displayed non-pvc floorings instead of the normal PVC based floorings”.

Comment by Ethan Lee:The Chinese supply chain are majorly focused in the development of new material applications which aims to meet potential environmental regulations that could seriously affect the PVC flooring market (LVT/SPC/Homogeneous). Over the past, Chinese manufactures has enjoyed rapid development from international trade, building production facilities that aims to meet the market demands in PVC resilient floorings. However, due to its mass production scales, the production facilities are also limited to use of polymers, hence when encountering the ban of PVC, the strategic direction is to use alternative polymers that can be implemented with existing equipment, instead of alternative natural materials. This is something we currently do not observe from local (China) suppliers.

2024 Domotex Hannover Observation Report

Expo Theme & Focus

Sustainability continues to be an ongoing topic being discussed during the panels in Domotex. Major green deal Carbon Neutral 2050 with the agenda for zero emission in production and product total life cycle are being discussed. Its worth noting that vinyl-free has been mentioned which suggest that alternative materials are being looked at for the construction industry as a whole.

According to the discussion, future financing can be associated with the bettering assessment in ESG and could be a potential leverage for firms that meets criterial. Some suggestions includes the application of bio-based resources to reduce energy use. The implement of recycled materials and enhancing recyclability of product are also a key aspects that leading brands are focusing.

The panel also discussed about the idea of take back obligations of floorings to help target the remove and recycling of flooring product.

Exhibition Participants and Suppliers

As one of the biggest flooring trade fair (globally), we see that the hard surface floorings being divided into three sections.

The first hall is presented with major flooring brands which can offer multiple categories of flooring products (include laminate floorings, resilient floorings and hardwoods floorings), and also more specialized brands that offer only one type of floorings.

The second hall is mostly concentrated with hardwood floorings, parkettes and engineering woods and we see a more dynamic mix of suppliers from across Europe, Mid East and Asia.

The last hall focus on floorings and suppliers from across Asia.

From the overall observations, we see a distinct advantages in product scales from Asia in resilient flooring categories. For laminate floorings are somewhat 50/50 between Asia vs Europe made. And Parkettes are nearly all finished in Europe locally.

Leading Brand Product Display

Through the display of hard surface products, we can observe there is still a high demand for conventional products when it comes to floorings. Price and costs are still a strong factor that effects the sales performance of decorative floorings.

Thus, while we saw there are many innovative products that are being introduced, with a few brands that are progressively promoting environmental and sustainable products (alternative materials), a large proportion of product displays are still focused in the conventional materials, especially for laminate and resilient floorings.

We also noticed that many of the global mega brands has not participated in the event, such as Shaw, Mohawk and etc. These implications suggest that mega brands are not fully prepared with launching of new materials (whether in Polypropylene or PET polymers in resilient floorings).

Retailers’ Park Sections

- Significantly less participants this year compared with any previous Domotex years.

- Agglomerate Maga Brands did not participating this year (Shaw/Mohawk/Karndean/etc).

- Diverse Comprehensive Product Suppliers (Tools, Paints, Siding, etc).

Indication for slow market growth and lower participation for 2024. Potentially from both construction projects and retailing (DIY sectors).

Product Innovation Directions and Implications

| Geographical Supplier | Product Innovations | Implications |

|---|---|---|

| Europe | Europe suppliers are more agile in terms of the use of alternative materials. Natural materials such as Cork are being offered, and more use of recycled materials such as recycled HDF, recycled natural fibers and use of combined materials. Digital printing is also an highlight that EU suppliers offer for premium customers. | While many EU associations are targeting towards the ban of PVC materials, we have observed that some local brands are already progressing towards use of natural materials or recycled materials. Its not clear whether vinyl free (with polymer materials) could have a strong proposition when comparing with natural/recycled materials. |

| China | Chinese suppliers continues to follow the same trend as previous China Domotex Event 2023 has observed. The use of alternative polymers to offer vinyl-free resilient flooring solutions. However, when it comes the use of recycled materials (HDF or Polymers), no suppliers were able to offer without the concern for toxic substances. | The Chinese manufacturers still has a strong economy of scale in terms of production capacity and price, but when facing potential regulation change, the supply chain as a whole are unable to offer alternative materials. The nation will need a stronger recycling system and material approval enforcements to be able to provide recycled materials as alternative, however there is no indication for such movements so far in the building material industry. |

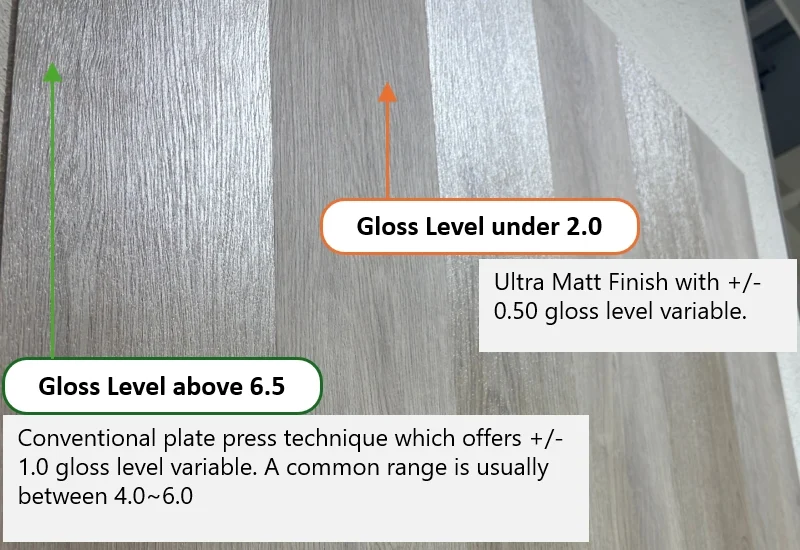

| Korea | Korean manufactures had not displayed any material innovation when it comes to hard surface floorings. However, they have offered an ultra-matt surface coating technology which makes a matt finish that is under 1.5~2.0 gloss level. | Standard Plating Press Techniques can meet the gloss level 2.0~4.0 range but the variation can be inconsistent. The gloss level in SPC is generally ranged between 4.0~6.0 range (Gloss level), and the Korean ultra-matt finish is said to provide a consistent variation with gloss level between 1.5~2.0. |

| Other Geographical Areas (Turkey, India. Viet Nam, Etc) | Suppliers from Turkey, India or Vietnam did not offer any product innovations. Just conventional PVC based resilient floorings. | Global leading brands mostly work with China based manufacturing due to its highly concentrated industry clusters, and so innovations are heavily supported from demand pull. |

Highlight Innovative Flooring Products at Domotex Exhibition Display

LI&PRA Second-Life Concept on Laminate Floorings

Made in Switzerland, this flooring product focus in the concept of “Second-Life” where the flooring is designed to be recycled and re-made into floorings again. The Fibrano collection is considered a laminate flooring with a digital printed decoration on top, a feature we do not often see from conventional laminate floorings. LI&PRA offers a complete product take back at product life end, and recycle and remake it by sanding down the digital print layer and replace with a new one.

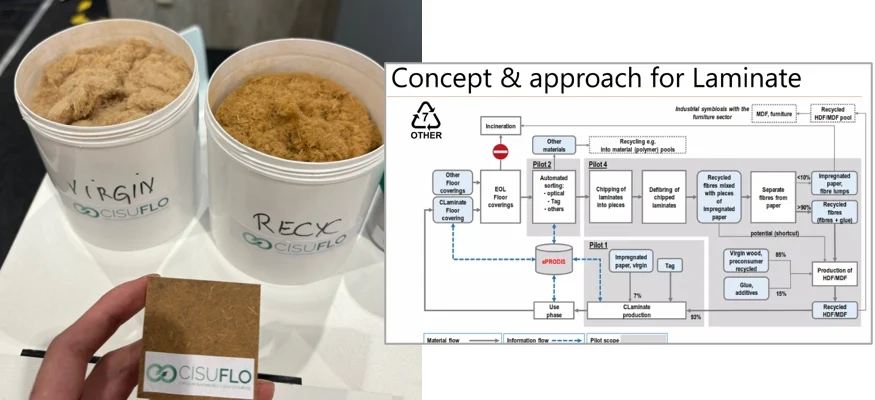

Unilin’s Recycled Laminate Flooring Technology

With the support of European Union, CISUFLO has launched programs to target the recycling of materials in laminates, resilient and textile floorings. The above picture displays materials of virgin and recycled wood fibers, and a sample board made from recycled wood fiber (into HDF).

Ceramin’s PVC Free SPC Flooring Solution

Made in Germany, Ceramin offers vinyl free resilient flooring by implementing Polypropylene polymers. Polypropylenes can be easily recycled through mechanical mean and does not loss as much of its original property performance when comparing to PVC polymers. The current formula allows Ceramin to add 25% of recycled Polypropylene into the rigid core, but we believe as formulation improves, this ratio can be further improved.

Note that recycled polypropylene plastics can actually cost more than the virgin materials.

Wicanders’ Cork Based Resilient Flooring

Wicanders Wise offers a bio-natural floorings that is made of cork. It is completely vinyl-free and the top layer (wear layer and print layer) is made from bio-based polymers. Bio-based polymers generate less green house gas and carbon emissions. What’s more! The top layer is also biodegradable!

Note: The concept and solution in biodegradable polymers hasn’t exactly been a popular or become mainstream. As many EU experts has disapproved it due to its limitation to be effectively biodegradable in any environments.

Digital Printing Trend in Europe Flooring Market

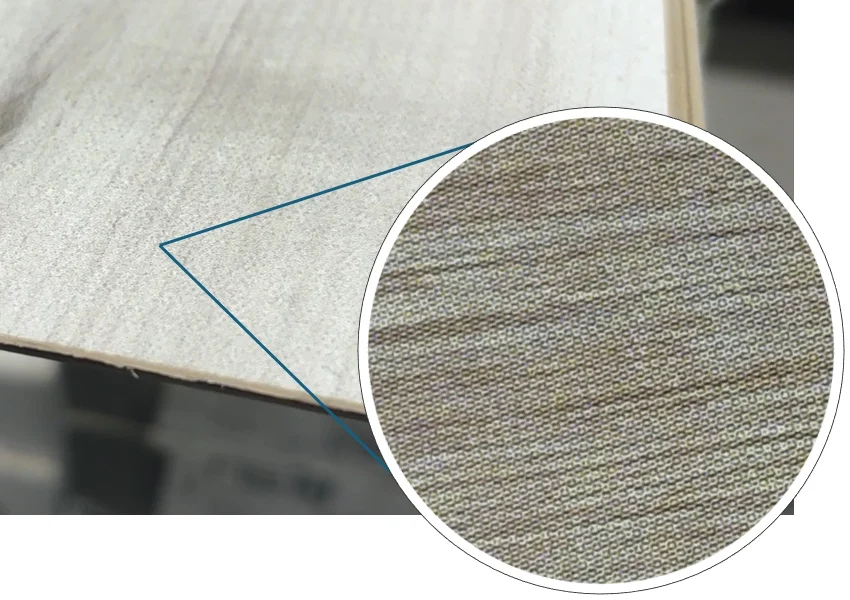

Digital printing is now becoming a thing that is currently occurring in the Europe market. (This is a trend that is currently not being observed in China as well as in North America Market).

The digital printing allows for highly customized designs made available with reduced repetition in pattern design and can offer any colors in need. Once the pattern design is selected, it can be made in production without the development time that is needed in gravure printing. With such advantages, digital printing is being implemented in many decorative surfaces, including walls and hard surface floorings.

Implications for Flooring Industry in Europe

With slow economy, European flooring manufacturers are now heading towards solutions for low NPD costs to improve ROI times.

Limitation in Digital Printing in Flooring

We see that digital printing is being introduced as a mean to reduce development costs (investment needs) and enables the capability to offer highly customized designs to consumers. There is a market niche for premium projects and digital printing offers a perfect solution for projects that needed this uniqueness.

However, when it comes to retailing and off the shelf products, the digital printed flooring can show distinct dot gain effect. While distributors may claim that the dot gain is nearly not visible when observed at 1 metre away (e.g. when standing up), it is still a concern especially when being displayed in retailing. Hence there is still improvements to be made for digital printing, and innovation for improved substrate or improving the shading rate to reduce the dot gain effect.

Ultra Matt Appearance

The ultra matt surface finish is being offered by Korean brand LX. The additional matt appearance is achieved by applying a specially formulated surface coating to the resilient floorings, and can maintain the variables within 0.5 gloss level. The above picture has shown the distinct difference in gloss level between ultra matt and a standard resilient flooring. The gloss level of ultra matt is under 2.0.

With conventional plating press technique, a common range used is between 4.0~6.0, but can also be reduced to range of 2.0~4.0. In theory the plate press can be adjusted to reach 1.0~3.0 range, but it will have less consistency and not practical if a standard were to be applied.

Implication on Asia Suppliers

Currently only Korean manufacturing (with exception to mega brand such as CFL) has the special coating technology to produce ultra matt finish. The ultra finish proved a more natural like appearance and could be more favorable for those who are looking for untreated wood style. The European flooring market has always preferred more in natural wood appearance and the ultra matt helps to improve the positioning of LVT/SPC.

Limitation on Matt Surface Flooring Manufacturing

Korean product price overall are higher than what is being offered by China, Vietnam or Thailand. The price for standard LVT and SPC can be has little is 25% higher compare to China, and the ultra matt coating will also incur additional costs into the product.